Why the trucking business is down? Freight recession. Freight rates. Freight Economy. Freight Business Slowdown.

- Peter Buyck

- Jan 12

- 3 min read

Why Is the Trucking Industry Experiencing a Slowdown?

The trucking industry, often seen as the barometer of economic health, has faced significant challenges in recent years. Declining freight rates, reduced demand, and an ongoing "freight recession" have created a difficult environment for carriers and drivers alike. Understanding the causes behind this slowdown can help industry stakeholders navigate these turbulent times and prepare for recovery.

The State of Freight

The "state of freight" serves as a snapshot of the trucking industry’s health. In 2024, many trucking companies experienced lower volumes of freight, driven by economic uncertainty and shifting consumer behavior. This slowdown has had ripple effects throughout the industry, impacting revenue, operations, and employment.

What Is a Freight Recession?

A freight recession occurs when the demand for freight transportation declines over a sustained period. Unlike a broader economic recession, a freight recession can happen even when the overall economy shows growth. Factors contributing to the current freight recession include:

Overcapacity: During the pandemic, many companies expanded their fleets to meet surging demand. As demand normalized, excess capacity led to increased competition and lower freight rates.

Consumer Spending Shifts: The pandemic drove a surge in e-commerce and durable goods purchases. As consumer spending shifted back to services and experiences, the need for freight transportation declined.

Inventory Destocking: Retailers and manufacturers who overstocked during supply chain disruptions are now reducing their inventory levels, further decreasing freight demand.

The Role of Freight Rates

Freight rates, a critical metric for the industry, have seen significant declines during the slowdown. Spot rates, which represent on-the-spot pricing for freight loads, dropped substantially in 2024 compared to their pandemic-era peaks. Contract rates, negotiated between carriers and shippers, have also softened as shippers leverage excess capacity to negotiate lower prices.

The falling rates create a squeeze for carriers, especially small and medium-sized operators. With high operational costs—including fuel, maintenance, and insurance—lower rates often mean operating at a loss.

Economic Pressures on Trucking

Several broader economic factors have compounded the trucking industry’s struggles:

Rising Interest Rates: Higher borrowing costs make it more expensive for companies to finance fleet expansions or cover cash flow gaps.

Rising Insurance Premiums: Trucking companies are experiencing rate hikes from insurance companies.

Fuel Price Volatility: While fuel prices have moderated since their peaks, ongoing volatility adds uncertainty to operating expenses.

Regulatory Challenges: Compliance with emissions standards, safety requirements, and labor regulations adds complexity and costs for carriers.

An Optimistic Outlook

Despite these challenges, the trucking industry remains resilient. There are several reasons to remain optimistic:

Economic Recovery: As the broader economy stabilizes, demand for freight transportation is expected to rebound. Sectors like construction, manufacturing, and retail are likely to drive future growth.

Technology Adoption: Advancements in telematics and automation offer opportunities for carriers to reduce costs and improve efficiency.

Consolidation and Innovation: Industry consolidation may help balance supply and demand, while innovative business models and partnerships can create new revenue streams.

Government Investment: Infrastructure investments and supply chain initiatives may support long-term industry growth.

Conclusion

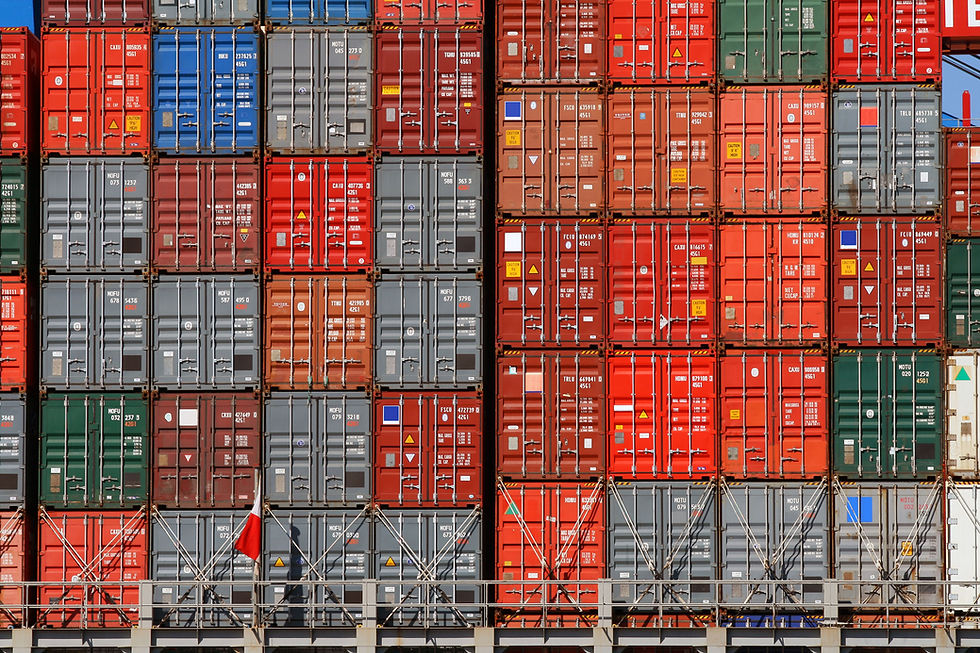

"Be fearful when others are greedy, and be greedy when others are fearful.”- Warren Buffet. While the trucking industry is currently navigating a difficult period marked by a freight recession, falling freight rates, and economic pressures, the long-term outlook remains promising. By adapting to market changes, investing in technology, and maintaining a focus on operational efficiency, industry stakeholders can position themselves for success as the state of freight improves. Many of the carriers that were not positioned for success are starting to exit the market. Fuel prices have come down substantially from their peaks. TruckStartup is here to set you up for success despite market uncertainty. Practically everything you see has at one point been on the back of a truck and that is not going to change anytime soon.

Comments